Owning a home can be complex. In fact, many homeowners might not be aware that there there is a need for additional coverage not offered on a standard homeowner’s policy. This is where your insurance agent can help identify the right policy, added coverages, and endorsements that you might need to stay protected.

Digging Into Service Line Coverage

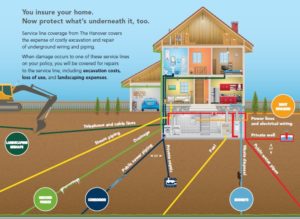

Many homeowners are surprised to learn that replacing or repairing damaged service lines is actually their responsibility. Think underground wiring and piping. For instance, damage can sometimes occur when least expected and expenses are not always covered on a basic homeowner’s policy. As a result, service line repairs can average $3-$4K and sometimes upwards of that.

You insure your home, why not protect what is underneath it too?

Service line coverage covers the expense of costly excavation and repair of underground wiring and piping. If damage occurs to one of these service lines on your policy you will be covered for repairs to the service line.

Does the covered service line need to be on my premise?

Yes. Likewise, the service line must also provide a service to the residence.

Can I replace the service line materials with more environmentally friendly materials?

Yes. Up to 150% of what the cost would have been to replace with like kind and quality using materials that are considered green.

What is the deductible for the coverage?

The Deductible is $500 per occurrence.

What if I damage the line while digging on the property?

The service line coverage endorsement extends coverage for breakage as a result of weight and equipment. For example, coverage applies if you crush a service line while digging in the yard.

What are the causes of loss that are covered when a service line failure occurs?

- Wear and Tear

- Rust or corrosion

- Mechanical Breakdown

- Collapse from above ground weight

- Artificially generated electric current

- Freezing or frost heave

- External force from excavation

- Tree or other root invasion

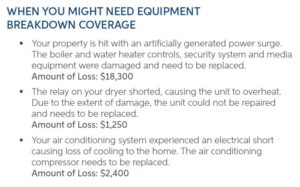

Protect the largest investment in your home with Equipment Breakdown Coverage

It’s important to note that a homeowner depends on any number of mechanical and electrical equipment systems. Air conditioners, heating units, computers, and major appliances. Any equipment failure is inconvenient, costly, and not always covered under warranty. This is where Equipment Breakdown Coverage comes into play.

What Equipment Breakdown covers

Above all, your important home systems and personal property would be covered due to loss by mechanical or electrical breakdown. No separate warranty programs or fees to manage the systems that you depend on the most.

- Air-conditioning units

- Compressors, pumps, engines

- Computers and other home electronics (TVs, auto systems)

- Electrical systems

- Furnaces

- Generators

- Home appliances (dish washers, washing machines, electric dryers)

- Hot-water heaters

- Motors, fans, vacuum systems,

- Refrigerators and freezers

- Security systems

- Smart home automation systems

- Swimming pool heating and filtration systems

- Lawn mower

Limits & Deductibles

Equipment Breakdown Coverage is offered on a per occurrence basis. A $500 deductible and a limit of $100,000 is available.

In conclusion, for more information about Service Line & Equipment Breakdown Coverage please contact your local insurance agent and they will be able to help you find the best coverages to keep you protected now and into the future.